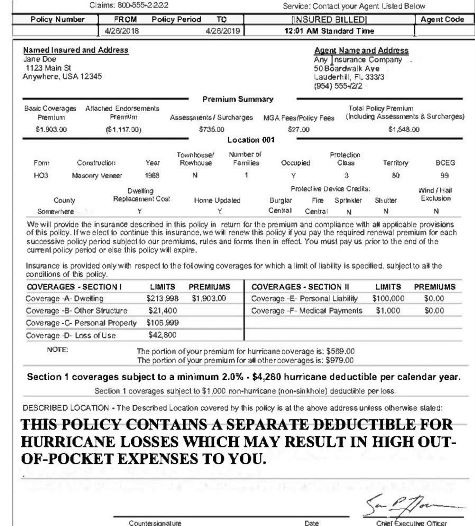

If your home is insured for $100,000, that means you’ll need to pay a $5,000 deductible for any hurricane-related claim on your home. Percentage deductibles are calculated based on the home’s insured value, and they typically apply to special coverages like hurricane insurance.įor instance, your hurricane coverage might have a percentage deductible of 5%. Tip: Depending on what coverage you have, you may also see your deductible listed as a percentage. So, if you have a $1,000 deductible and file a claim for a $5,000 covered loss, your insurance will pay out $4,000 for the damages. In practice, the insurance company subtracts the deductible from your claim amount before issuing payment. The declarations page may list an “all peril” deductible, which means you pay a fixed amount for each claim you make on any loss, as long as the damages didn’t result from an event specifically excluded from your policy. This section of the declarations page lists all the deductibles that apply to your policy. Your deductible is the amount you pay before your insurance company pays on a claim. These coverages are typically divided into two sections on your declarations page - property coverages (Section I) and liability coverages (Section II).įor example, on its declarations page example, the Maryland Insurance Association lists dwelling, other structures, personal property, and loss of use coverage in Section I, and the other two coverages in Section II. The declarations page lists the specific coverages included in your homeowners policy and the amount of coverage you have for each item.

You’ll also see the effective date of the policy, which is the date your coverage starts, and the expiration date. The policy period indicates how long your coverage is in effect - six or 12 months, for example. You’ll see your policy number, policy type, and policy period listed on the dec page. This section also contains the contact information for your insurance company, insurance agent, and mortgage company. Your phone number may be included here as well. Your declarations page summarizes a number of key details about your homeowners insurance policy, including: Contact informationĪt the top of the page, you’ll find the named insured - that’s you and anyone else covered under your insurance policy - and the home address. Homeowners insurance declarations page explanation What isn’t included in a homeowners insurance declarations page?.How and when to get your homeowners insurance declarations page.Homeowners insurance declarations page explanation.Here’s what you need to know about your homeowners insurance declarations page: You’ll receive a declarations page whenever you purchase home insurance or make changes to your current policy. It also serves as your proof of coverage. It provides important information about your policy, like the policy number, the types of coverage you have, your premium and deductible amounts, and when the policy begins and ends. NMLS # 1681276, is referred to here as "Credible."Īn insurance policy declarations page, also called a “dec” page, is a summary of your homeowners policy. By refinancing your mortgage, total finance charges may be higher over the life of the loan.Ĭredible Operations, Inc. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Our goal is to give you the tools and confidence you need to improve your finances.

0 kommentar(er)

0 kommentar(er)